New York Minimum Wage Law Firm Serving NYC, Long Island, Westchester, and Rockland

On April 4, 2016, New York Governor Andrew Cuomo signed legislation enacting a statewide Minimum Wage Plan to raise the minimum wage for all New York workers to $15.00 per hour.

The Minimum Wage Plain will be implemented on a staggered basis and will ultimately reach $15 per hour for all workers in all industries across New York State.

Workers in New York City employed by businesses with 11 or more employees must be paid at a minimum wage rate as follows:

- $11.00 per hour, effective December 31, 2016

- $13.00 per hour, effective December 31, 2017

- $15.00 per hour, effective December 31, 2018

Workers in New York City employed by businesses with 10 employees or less must be paid at a minimum wage rate as follows:

- $10.50 per hour, effective December 31, 2016

- $12.00 per hour, effective December 31, 2017

- $13.50 per hour, effective December 31, 2018

- $15.00 per hour, effective December 31, 2019

Workers in Nassau, Suffolk and Westchester Counties must be paid at a minimum wage rate as follows:

- $11.00 per hour, effective December 31, 2017

- $12.00 per hour, effective December 31, 2018

- $13.00 per hour, effective December 31, 2019

- $14.00 per hour, effective December 31, 2020

- $15.00 per hour, effective December 31, 2021

Workers in the rest of New York State must be paid at a minimum wage rate as follows:

- $9.70 per hour, effective December 31, 2016

- $10.40 per hour, effective December 31, 2017

- $11.10 per hour, effective December 31, 2018

- $11.80 per hour, effective December 31, 2019

- $12.50 per hour, effective December 31, 2020

- To be determined, effective December 31, 2021, and each succeeding December 31, as the minimum wage will continue to increase by a percentage determined by the Director of the Division of Budget in consultation with the New York State Department of Labor until it reaches $15 per hour.

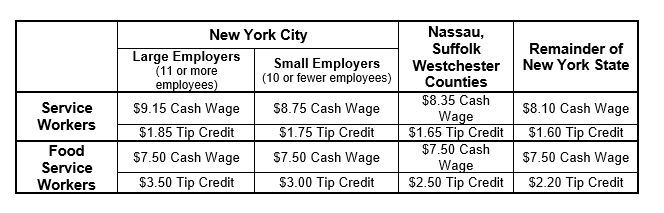

Tipped Service and Food Service Workers

New York State law allows employers in all industries (other than the building service industry) to satisfy the minimum wage by combining a “cash wage” paid by the employer with a tip credit or allowance for tips that workers receive from customers.

For example, the minimum wage rate for Food Service Workers who work for large employers in New York City is $11.00 per hour as of December 31, 2016. These Food Service workers’ employers may satisfy the minimum wage by combining a Cash Wage of at least $7.50 with a Tip Credit of no more than $3.50 per hour as shown in the chart below.

Effective December 31, 2016, Tipped Workers in the Hospitality Industry must be paid at the minimum hourly “Cash Wage” amounts as follows:

However, employers may take a tip credit towards the basic minimum hourly rate only if their workers have received enough tips and have been notified of the tip credit.

Fast Food Workers

Fast Food Workers in New York City must be paid at a minimum wage rate as follows:

- $12.00 per hour, effective December 31, 2016

- $13.50 per hour, effective December 31, 2017

- $15.00 per hour, effective December 31, 2018

Fast Food Workers outside of New York City must be paid at a minimum wage rate as follows:

- $10.75 per hour, effective December 31, 2016

- $11.75 per hour, effective December 31, 2017

- $12.75 per hour, effective December 31, 2018

- $13.75 per hour, effective December 31, 2019

- $14.50 per hour, effective December 31, 2020

- $15.00 per hour, effective July 1, 2021

No tip credit is permitted for Fast Food Workers.

If you or someone you know has been denied minimum wage, or are victim to unlawful practices by your employer, call the law firm of Neil H. Greenberg & Associates today at 1-866-546-4752 to schedule a free consultation. The firm’s team of skilled and experienced attorneys are waiting to answer your questions and to help you protect your legal rights.